IR35

HMRC introduced IR35 in 1999. IR35 reforms introduced in the public sector in 2017 and the private sector in 2021 meant that the responsibility for determining a contractors worker status shifted to the organisation engaging their services.

The Ir35 Reform 7 Key Challenges And How To Overcome Them Hr Strategy Hr Grapevine Insight

The 2017 and 2021 reforms to the off payroll working rules - also known as IR35 - were a tax law that required the end client and not the contractors they hire to decide if the working.

. Changes to IR35 were outlined in the recent mini-budget. The goal of IR35 is to ensure that. Portable air conditioners at walmart.

Printable princess coloring pages. The IR35 tax avoidance reforms were first introduced in the public sector back in April 2017 and ushered in a sizeable shift in responsibility within the extended end-client-to-contractor labour. IR35 is a piece of tax legislation designed to stop companies from employing contractors as disguised employees.

Annual turnover Not more than 102 million. List of information about off-payroll working IR35. Wed like to set additional cookies to understand how you use GOVUK remember your.

The calculator assumes you work 5 days per week 44 weeks per year. IR35 is the abbreviated name for the anti-tax avoidance legislation that was introduced in April 2000. Fill in the yellow boxes to calculate your net income inside and outside IR35.

Inside and Outside IR35. IR35 refers to United Kingdom s anti-avoidance tax legislation designed to tax disguised employment at a rate similar to employment. These rules are sometimes known as IR35.

Answering the above questions. But now theyve scrapped the national insurance levy but kept the dividends increase. How to use the IR35 calculator.

Tell the interviewer what steps you. The aim was to clamp down on individuals working in a manner similar to an employee but under the guise of a limited company. Debugging in the context of software development refers to finding analyzing and rectifying defects in softwareSoftware engineers undertake this activity when a software system fails to meet its objectives.

While IR35 had previously been present within the public sector its now been rolled out across private organisations impacting roughly 60000 businesses 20000 agencies and 500000 contractors across the UK. On Friday 23 September 2022 the Chancellor Kwasi Kwarteng announced an intention to repeal the off-payroll working legislation from April 2023. In this context disguised employees means workers who receive payments from a client via an intermediary for example their own limited company and whose relationship with their client is such that.

The government will repeal these reforms. Self-employed IR35 rules are designed to work out whether a contractor is someone whos genuinely self-employed rather than a disguised employee for the purposes of paying tax. 2 days ago Question 7.

Balance sheet total Not more than 51 million. Nearly all of the tax measures in the growth plan have. The governments sudden repeal of the IR35 changes introduced to the public sector in 2017 and the private sector in 2021 has come as a surprise to all in HR and recruitment.

Theyve also U-turned on the reduction of dividend rates. What is IR35. IR35 also known as the intermediaries legislation applies where an individual provides their services to a client via an intermediary such as a personal service company this arrangement is known as off-payroll working but the relationship with the client would otherwise suggest employment status.

Travel expenses cover any travel subsistence and accommodation costs incurred on contract duty and falling within the HMRC Travel Rules for site-based employees. IR35 also known as the Off-Payroll Working Rules may apply when the freelancer operates under a personal services or similar company. Dave Chaplin CEO of IR35 compliance solution IR35 Shield explores and explains what these changes could be and how they might work.

The new chancellor Jeremy Hunt has scrapped the IR35 reform repeal that was planned by his predecessor Kwasi Kwarteng. The IR stands for Inland Revenue and the 35 is the press release issue number. They may also be known as the engager hirer or end client.

IR35 is another name for the off-payroll working rules. Despite the time and expense that organisations have invested in managing these changes the U-turn has largely been welcomed by HR procurement and legal teams. Mr Hunt made a number of changes to Mr Kwartengs mini-budget which resulted in political and financial turmoil in the UK.

The client is the organisation who is or will be receiving the services of a contractor. We use some essential cookies to make this website work. IR35 is governed by Her Majestys Revenue and Customs which absorbed Inland revenue back in 2005.

The term IR35 refers to the press release that originally announced the legislation in 1999. The whole point of increasing them was to mirror the increase to national insurance. Explain the role of debugging in the software development process.

In general IR35 shifts the responsibility of worker classification from self-employed individuals working through their own limited company to in some cases their clients. Once again like during COVID times the contractor market is getting no support from this government. The definition of small business for IR35 exemptions is likely to be based on the definition in the Companies Act which is met if a company meets any two of the three triggers below.

Changes To Ir35 Legislation Gazelle Global Consulting

Ir35 Understanding The Changes To Off Payroll Working

Inside Ir35 Working Via An Umbrella Company Clarity Umbrella Ltd

![]()

Your Ir35 Compliant Partner Solve The Ir35 Riddle Projects Resource

What Is Ir35 Ir35 Explained For Contractors Totaljobs

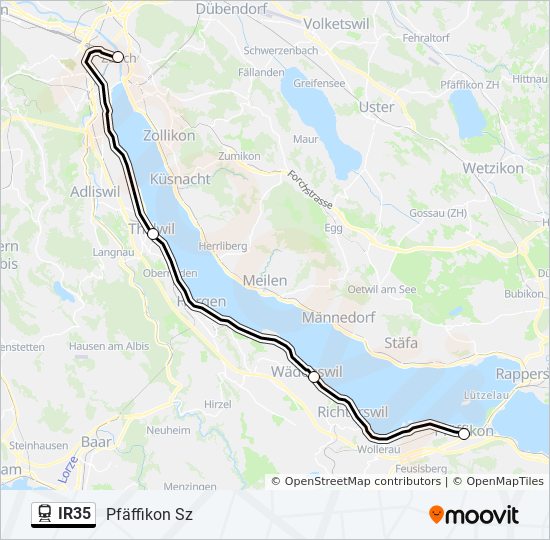

Ir35 Route Fahrplane Haltestellen Karten Pfaffikon Sz Aktualisiert

What Is Ir35 Markel Direct Uk

Plt0oi5okllx5m

How Will My Take Home Pay Be Affected By Ir35 Sg Accounting

Large And Medium Sized Businesses Need To Be Ready For Ir35 Accountants Bury St Edmunds Thetford Knights Lowe

All You Need To Know About Ir35 Changes By Caroline Vooght

Was Bedeuten Die Anderungen Der Britischen Vorschriften Fur Die Beschaftigung Ausserhalb Der Lohn Und Gehaltsliste Ir35

Understanding Ir35 Robert Half Uk

What Is Ir 35 Tick Hr

Ir35 Law Update What Do Smes Need To Know

Ir35 Insurance Roots Contractor Insurance

Ir35 Tax Rules Will Ring The Changes For Contractors Business Rescue Expert