Walmart sales tax calculator

Thus here is a list of Terminologies involved in the. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

Sales Tax Calc Discount 50 Off Www Wtashows Com

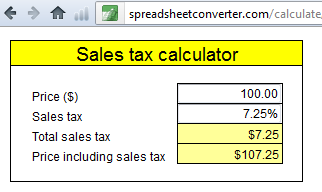

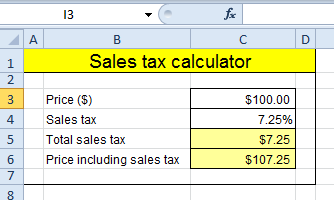

To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax.

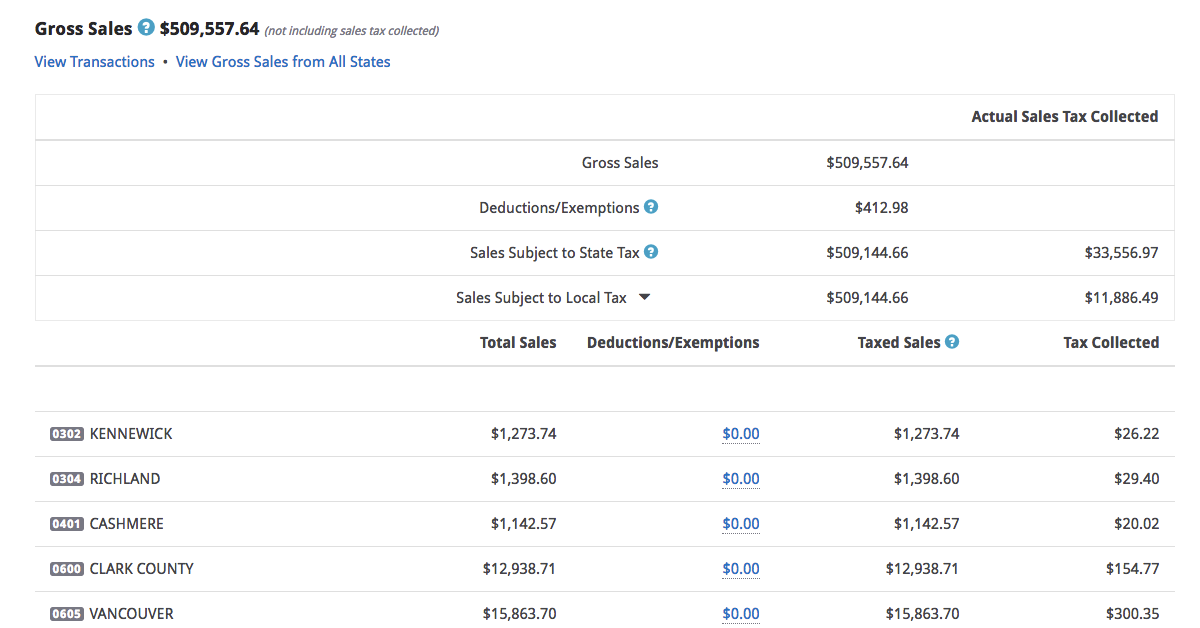

. Virginia VA Sales Tax Rates by City R The state sales tax rate in Virginia is 4300. Walmart charges a percentage of the gross sales proceeds from the sale of each product. Download the current Sales Tax Codes for Walmart Marketplace by clicking below.

Include a brief Tax Policy to let Walmart. It is acceptable to use the generic tax code 2038710. With local taxes the total sales tax rate is between 5300 and 7000.

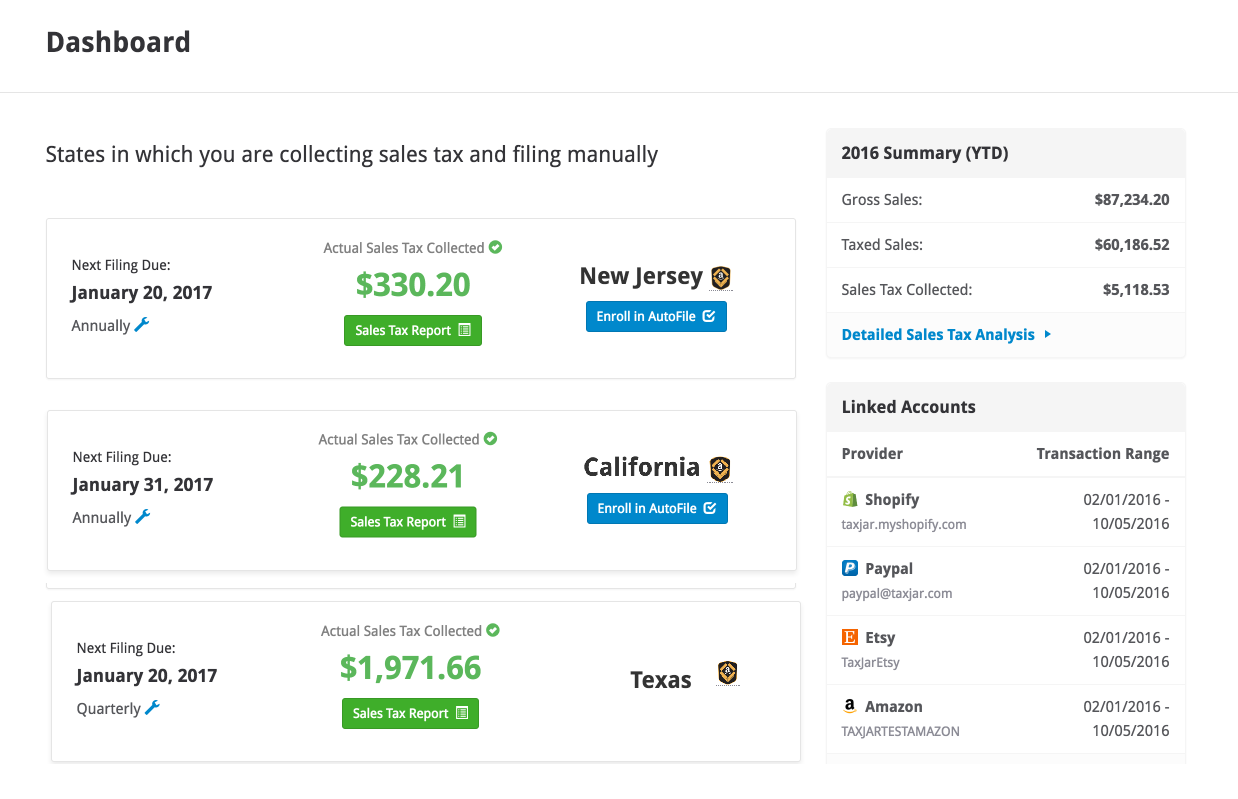

Filing and remitting sales tax for your Walmart store has never been easier. This includes the rates on the state county city and special levels. How do you figure out what the sales tax rate is.

You can calculate the sales and use tax rate in your area by entering an address into our Sales Tax Calculator. Weve got your back. The calculator on this page is.

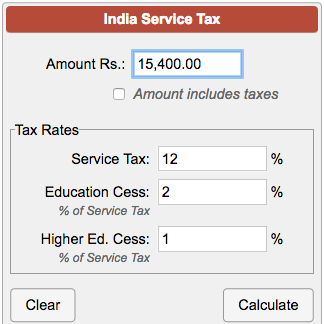

The average cumulative sales tax rate in Reston Virginia is 6. For a look at sales. Amount Tax Inclusive.

CATIGA CD-8185 Basic Calculator For Home and Office 8 Digits Large Buttons Solar and Battery Powered Robust Build. A financial advisor in Virginia can help you understand how taxes fit into your overall financial goals. Essentials of Walmart Sales Tax.

Configuring Sales Tax At Walmart Com Without Breaking A Sweat Offer 1 - staff revenue accountant so reading. Make this year your best ever with big savings on top brands so much more at Walmart. Total CostPrice including ST.

Reston is located within Fairfax County Virginia. More about shipping sales tax codes. The statewide rate is 65.

Accuracy guaranteed With economic nexus determination and guaranteed accurate calculations TaxJar ensures you. Net Amount excluding tax 10000. Sales Tax Rate for Food and Personal Hygiene Products Sales of food for home consumption and certain essential personal hygiene products are taxed at the reduced rate of 25 throughout.

Ad Score big savings on what you want need most at Walmart. This will provide a combined sales tax rate for a location. Gross Amount including tax 10888.

Tax Rate Includes Tax. In order to configure Walmart Sales Tax you should know what essential information is required. Sales tax is calculated by multiplying the purchase price by the.

Under the Tax Codes section enter one tax code per shipping option. Most categories charge 15. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Skip to Main Content. Up to 4 cash back From 999. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

Financial advisors can also help with investing and financial plans including retirement. Youll use this list to complete Item Setup BUT do not need it to. Walmart Seller Fee Calculator 2021 - Price Your Products.

In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return.

Sales Tax Calculator Taxjar

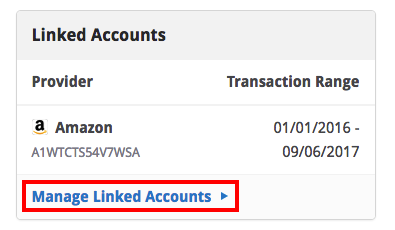

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

How To Charge Your Customers The Correct Sales Tax Rates

Sales Tax Calculator Cheap Sale 56 Off Www Alforja Cat

How To Calculate California Sales Tax 11 Steps With Pictures

Sales Tax Calc Discount 50 Off Www Wtashows Com

Walmart Sales Tax How To Do It The Right Way A2x For Amazon And Shopify Accounting Automated And Reconciled

Walmart Integration Taxjar

Configuring Sales Tax At Walmart Com Without Breaking A Sweat

Walmart Canada 12 Digit Tax Calculator Walmart Canada

Sales Tax Calc Discount 50 Off Www Wtashows Com

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

You Can Now Simplify Your Walmart Marketplace Sales Tax With Taxjar Taxjar

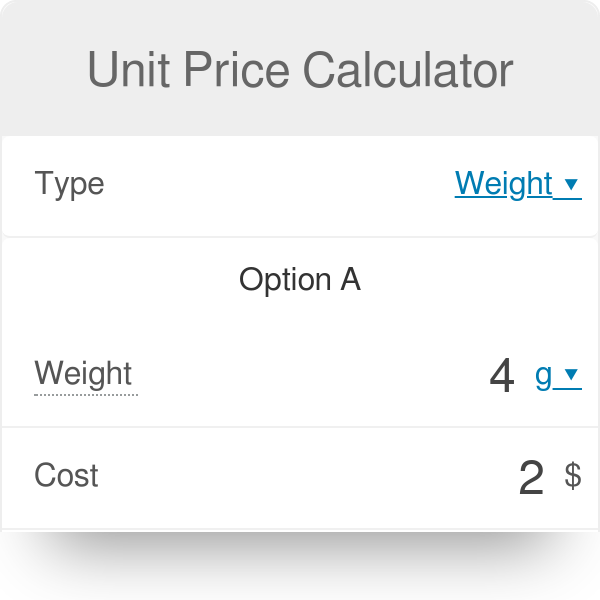

Unit Price Calculator Which Item Is Cheaper

How To Calculate California Sales Tax 11 Steps With Pictures

Sales Taxes In The United States Wikiwand